Aptean Insights

Whether you’re looking for industry insights, product details, upcoming events or our latest news it’s all right here. Browse the categories below or get in touch with one of our experts if you have a question.

Results

Showing1-15of2039

Blog Post Dec 12, 2025Apparel ERP Benefits in Action: Customer Success Stories and TestimonialsDiscover how apparel businesses are transforming operations with an ERP built for the industry. Explore real customer success stories and testimonials showcasing improved efficiency, accuracy, and growth.

Blog Post Dec 12, 2025Apparel ERP Benefits in Action: Customer Success Stories and TestimonialsDiscover how apparel businesses are transforming operations with an ERP built for the industry. Explore real customer success stories and testimonials showcasing improved efficiency, accuracy, and growth.Learn More

Datasheet Dec 10, 2025Aptean Transportation Management System (TMS) for Apparel WholesalersDiscover how Aptean’s Transportation Management System helps apparel wholesalers streamline logistics, reduce shipping costs, and improve delivery efficiency with smarter, automated workflows.

Datasheet Dec 10, 2025Aptean Transportation Management System (TMS) for Apparel WholesalersDiscover how Aptean’s Transportation Management System helps apparel wholesalers streamline logistics, reduce shipping costs, and improve delivery efficiency with smarter, automated workflows.Download

eBook Dec 9, 2025The Algorithm: AI from Concept to Competitive AdvantageDownload Edition 2 of The Algorithm to see how AI is becoming a true differentiator, with insights on agentic AI, expert perspectives, and real-world adoption from brands like Aviva.

eBook Dec 9, 2025The Algorithm: AI from Concept to Competitive AdvantageDownload Edition 2 of The Algorithm to see how AI is becoming a true differentiator, with insights on agentic AI, expert perspectives, and real-world adoption from brands like Aviva.Download

Datasheet Dec 3, 2025Aptean Food & Beverage ERP FoundationAptean Food & Beverage ERP Foundation offering provides a simplified, economical deployment tailored for small and midsize businesses, ensuring a smooth and efficient implementation without sacrificing quality.

Datasheet Dec 3, 2025Aptean Food & Beverage ERP FoundationAptean Food & Beverage ERP Foundation offering provides a simplified, economical deployment tailored for small and midsize businesses, ensuring a smooth and efficient implementation without sacrificing quality.Download

Success Story Nov 27, 2025Tecumseh Tunes Up Tech Stack With Aptean TMSDiscover how Tecumseh streamlined operations and boosted efficiency by implementing Aptean TMS. See the impact of smarter logistics technology on performance.

Success Story Nov 27, 2025Tecumseh Tunes Up Tech Stack With Aptean TMSDiscover how Tecumseh streamlined operations and boosted efficiency by implementing Aptean TMS. See the impact of smarter logistics technology on performance.Download

Blog Post Nov 26, 2025Real Route Planning Software Benefits According to the Businesses That Use ItDiscover real route planning software benefits—cost savings, efficiency gains and on-time delivery—straight from the companies using Aptean Routing & Scheduling.

Blog Post Nov 26, 2025Real Route Planning Software Benefits According to the Businesses That Use ItDiscover real route planning software benefits—cost savings, efficiency gains and on-time delivery—straight from the companies using Aptean Routing & Scheduling.Learn More

Product Tour Nov 24, 2025See Our Shop Floor Control Software In ActionExplore how our shop floor control software unifies operator activity, performance monitoring and production visibility in one easy-to-use platform.

Product Tour Nov 24, 2025See Our Shop Floor Control Software In ActionExplore how our shop floor control software unifies operator activity, performance monitoring and production visibility in one easy-to-use platform.Start My Product Tour

eBook Nov 20, 2025Your Discrete Manufacturing Solutions Buyer's GuideExplore the essential features, benefits and key considerations for choosing the right discrete manufacturing software. Get the insights you need to make a confident, informed decision.

eBook Nov 20, 2025Your Discrete Manufacturing Solutions Buyer's GuideExplore the essential features, benefits and key considerations for choosing the right discrete manufacturing software. Get the insights you need to make a confident, informed decision.Download

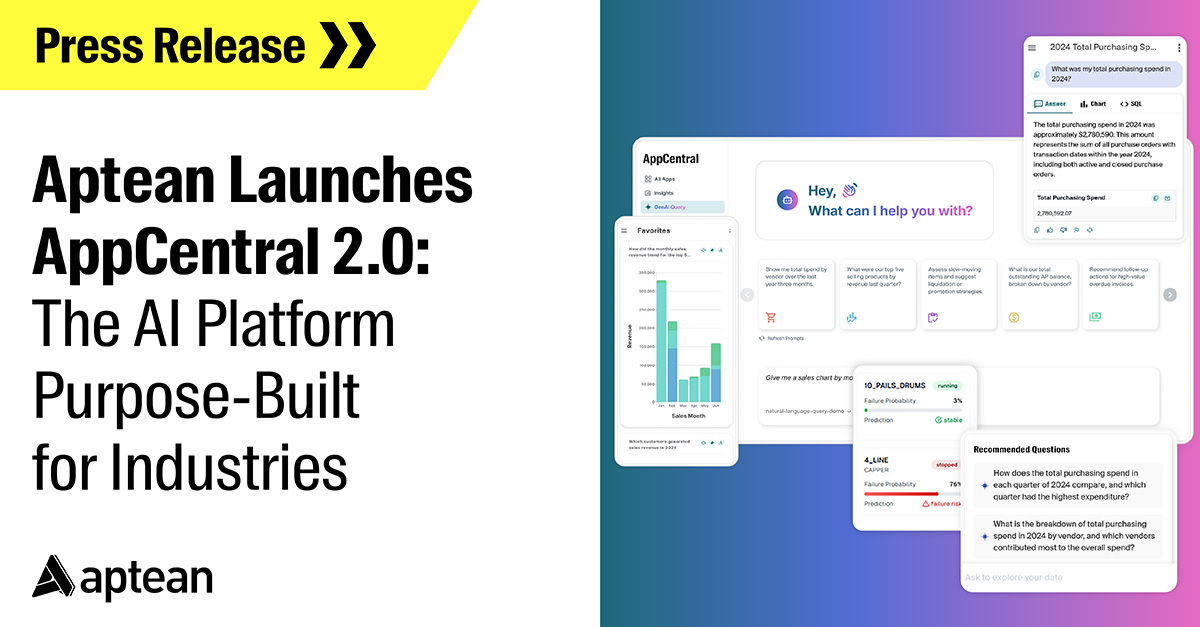

Press Release Nov 20, 2025Aptean Launches AppCentral 2.0: The AI Platform Purpose-Built for IndustriesAptean unveils AppCentral 2.0, an AI platform for industries that drives smarter decisions, faster operations, and real-time business agility.

Press Release Nov 20, 2025Aptean Launches AppCentral 2.0: The AI Platform Purpose-Built for IndustriesAptean unveils AppCentral 2.0, an AI platform for industries that drives smarter decisions, faster operations, and real-time business agility.Read more

Blog Post Nov 19, 2025Democratizing AI: What It Means and How No-Code AI Tools Empower Your EmployeesDiscover how no-code AI puts powerful capabilities into the hands of nontechnical staff, helping every employee work faster, smarter and more confidently.

Blog Post Nov 19, 2025Democratizing AI: What It Means and How No-Code AI Tools Empower Your EmployeesDiscover how no-code AI puts powerful capabilities into the hands of nontechnical staff, helping every employee work faster, smarter and more confidently.Learn More

eBook Nov 19, 2025FSMA 204 and Food Safety ComplianceLearn how FSMA 204 impacts food traceability and compliance. Discover key requirements, recordkeeping rules, and steps to ensure your food safety program meets standards.

eBook Nov 19, 2025FSMA 204 and Food Safety ComplianceLearn how FSMA 204 impacts food traceability and compliance. Discover key requirements, recordkeeping rules, and steps to ensure your food safety program meets standards.Download

Datasheet Nov 14, 2025Aptean Industrial Manufacturing ERP – Traverse Edition DatasheetConnect your business, automate processes, and get instant insights with Aptean Industrial Manufacturing ERP Traverse Edition on AppCentral.

Datasheet Nov 14, 2025Aptean Industrial Manufacturing ERP – Traverse Edition DatasheetConnect your business, automate processes, and get instant insights with Aptean Industrial Manufacturing ERP Traverse Edition on AppCentral.Download

Blog Post Nov 14, 2025AI Route Optimization: Logistics Levels UpDiscover how AI route optimization gives logistics the Daft Punk treatment: “Harder, Better, Faster, Stronger.” Smarter routes, lower costs, happier customers.

Blog Post Nov 14, 2025AI Route Optimization: Logistics Levels UpDiscover how AI route optimization gives logistics the Daft Punk treatment: “Harder, Better, Faster, Stronger.” Smarter routes, lower costs, happier customers.Learn More

Dec162025Event / WebinarVirtual UNITE AI Summit Join the Movement: Everything Connected, Everything ClearDec 16, 2025 OnlineJoin the Virtual UNITE AI Summit to explore the future of AI, connectivity, and clarity. Discover insights, innovations, and global collaboration in one powerful event.

Dec162025Event / WebinarVirtual UNITE AI Summit Join the Movement: Everything Connected, Everything ClearDec 16, 2025 OnlineJoin the Virtual UNITE AI Summit to explore the future of AI, connectivity, and clarity. Discover insights, innovations, and global collaboration in one powerful event.Register Now

Success Story Nov 11, 2025Leading Producer of Frozen Fish Concepts Embraces Innovative, Step-by-Step Digitalization With Cloud-Based Food ERPDiscover how this leading producer of frozen fish products modernized operations with Aptean’s industry-specific ERP and by-your-side support.

Success Story Nov 11, 2025Leading Producer of Frozen Fish Concepts Embraces Innovative, Step-by-Step Digitalization With Cloud-Based Food ERPDiscover how this leading producer of frozen fish products modernized operations with Aptean’s industry-specific ERP and by-your-side support.Read Story

Ready To Start Transforming Your Business?

We’ve got the specialized industry software to help your organization thrive.