Leveraging Complaints Data - What Does It Look Like in Practice?

Leveraging Complaints Data - What Does It Look Like in Practice?

Leveraging Complaints Data - What Does It Look Like in Practice?

20 May 2022

Eric Brown | Manager, Solutions Consultants

Eric Brown | Manager, Solutions Consultants

Our recent blog looked at the importance and value of complaints data, exploring the need to go beyond standard reporting, climbing the maturity ladder by putting data-driven decision-making at the very heart of your business. But what are the practicalities of doing this? How do we actually ‘go beyond’ standard operational metrics and what do ‘good’ outputs look like when it comes to maximising the value of your complaints data?

Before we delve deeper into the issue, we must pause for thought to consider how to use customer data not only wisely, but ethically and in the customer’s best interest too.

Use Customer Data Wisely and Ethically

While GDPR might have ticked data protection boxes, there is one area it doesn’t cover: are we using data in the customer’s best interest? A great many of us might accept a website’s cookies and an app’s T&Cs without giving it too much thought because the actual impact of this is often relatively trivial, with the exception of perhaps a few annoying texts or emails. But, consider the bigger picture, namely how is your organisation using this data to make decisions? Is the data being used to set insurance premiums, make loan decisions, provide or decline health insurance, for example, and is this fair and equitable?

It's a huge issue but one that isn’t insurmountable, as long as we all set our ethical compasses in the direction of what’s in the best interest of our customers, ensuring we make use of customer data in an ethical way.

Ask the Right Questions of Your Data

Back to our main issue of how to maximise the value of your complaints data. The key is to ask questions of the data – so what is it you want the data to answer for you? Of course, there are an infinite number of questions you can ask, but here are two examples and another for inspiration:

How do I maintain the customer experience even when operations are impacted by other external factors?

How can I understand the true cost of complaints to the business, i.e., just how valuable is the complaint function?

How can I demonstrate that we are treating our customers fairly and that we understand our customer base?

Maintaining the Customer Experience in the Face of Disruption

To answer question one, we must use complaints data in conjunction with data from elsewhere in the business to consider ‘what if’ scenarios. Your industry will have different contributing factors, but we’ve used an example from a fictitious general insurer, analysing the impact of various events in order to understand the impact on their service levels, the volumes received and, ultimately, staffing needs.

This ‘what if’ modelling approach enables firms to be hyper-focussed in targeting their resources where they’re needed most. For example, there’s little point in scaling-up complaint resources relating to Product A when we know through modelling that the event in question will have more of a significant impact on Product B.

Understand the True Value of the Complaints Function

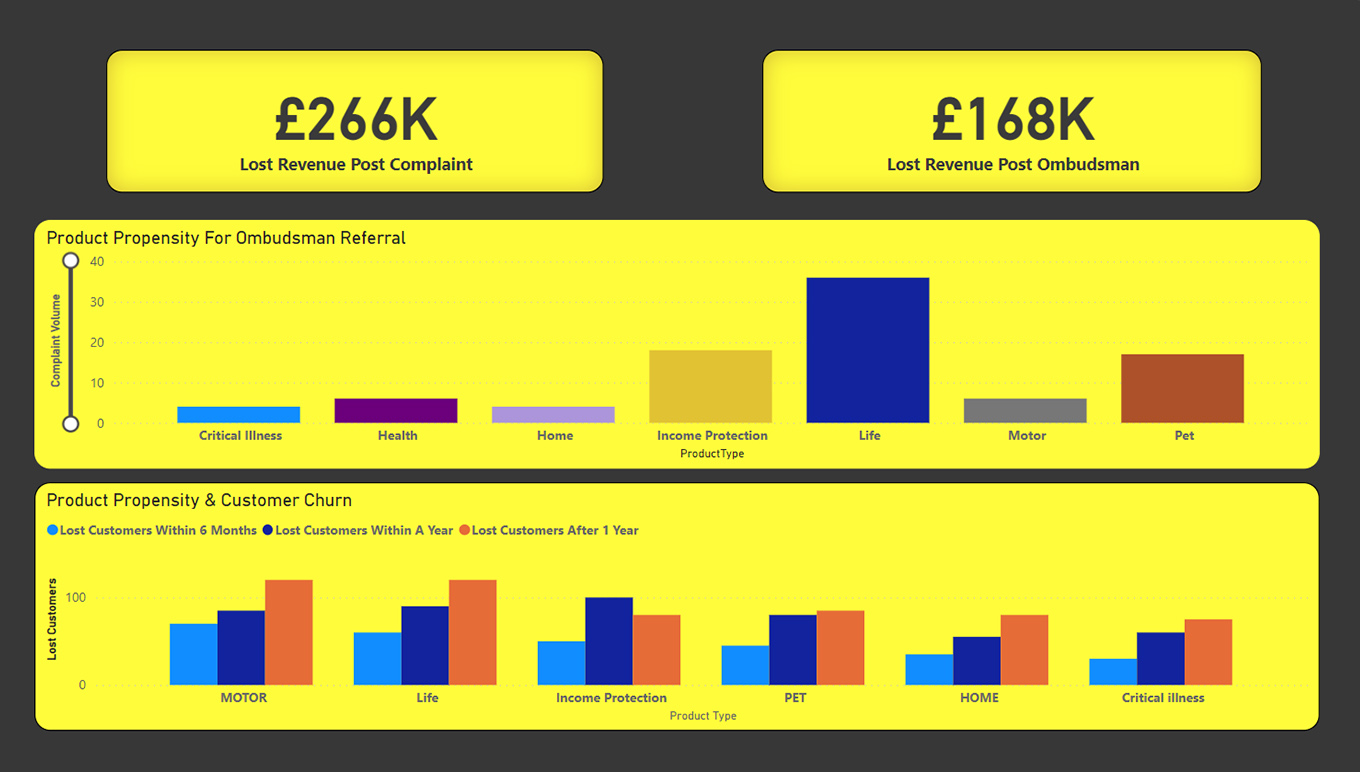

And now for question two. There are a multitude of ways to draw correlations when complaints data is analysed in conjunction with enterprise-wide data. For instance, you can uncover patterns in how often a specific type of complaint about a particular product is referred to an ombudsman. This type of insight may highlight some systemic problems but, at a far deeper level, this type of information helps you to better understand the impact on top line revenues. This example shows the likelihood of customer churn by product and how that will affect top line revenue following a complaint.

Broaden Your Horizons

Going back to the point about the ethical use of data, the FCA’s Consumer Duty shifts the focus to be more in the customer’s interest, which begs the question whether root cause analysis (RCA) alone is enough to meet this requirement?

With this in mind it’s imperative to not just limit your efforts to data that you own, instead consider additional data that’s available in the public domain as a reliable benchmark. For example, you can use published date from both the FCA and FOS to understand if you are comparable to peers in your sector of financial services, or to find out if you’re receiving the same volume of complaints per 1000 customers as your peers. Equally, you can look at if you’re having a comparable percentage of cases referred to the ombudsman, or if your uphold and redress rates are the same.

Such widespread, all-encompassing analysis provides reliable insight as to whether or not you’re treating your customers fairly; if you’re providing good customer outcomes and, crucially, helping to ensure there’s no undue harm to your customers.

Best Practice

This isn’t a pipe-dream. Organisations are seeing real business benefits from going beyond when it comes to deriving maximum value from their data. By strategically leveraging their complaints data, delivering timelier business insight to enable more data-driven decision-making, one organisation was able to redeploy 75% of its analytical team whilst increasing output by 100%.

There are business benefits, regulatory benefits and customer benefits to be reaped from viewing your complaints data through a different lens and it’s true that there really is gold to be struck in your complaints data. The key is to unlock your data’s potential, engaging with analytical expertise to combine complaints data with enterprise information and publically-available information to go beyond the norm for the benefit of not only your business but your customers too.

Built on the foundation of user-friendly standard reporting for your Complaints and Compliance Management needs, Respond Business Intelligence (BI) gives you ultimate insight and flexibility over your complaints data. It outputs Respond data in a standard online analytical processing (OLAP) reporting format, allowing you to leverage the reporting tools of your choice to slice and dice the information. Respond BI expands on the data-driven complaints function you rely on today, delivering timely, accurate and in-depth insights to take your Complaints and Compliance Management to the next level.

To find out how Aptean Respond could help your business unlock its complaint management potential, contact us today.

Achieving Customer Service Excellence with Aptean Respond

In this eBook, you will learn about the success organisations like yours have had when using Aptean Respond for their complaint and case management.