Featured in this post

5 Key Insights for Fashion and Apparel Manufacturers in 2023

5 Key Insights for Fashion and Apparel Manufacturers in 2023

14 Feb 2023

Aptean Staff Writer

Aptean Staff Writer

The fashion and apparel industry moves fast, so brands are accustomed to rapid change. Even so, 2022 threw the industry some serious curveballs. The highest inflation in 40+ years. Broken or underperforming supply chains. Rising costs and tariffs. Stepped up pressure for ESG mandates.

What internal and external challenges will shape fashion and apparel business strategy in 2023? How will brands ensure future growth?

To find out, Aptean commissioned the B2B International market research firm to survey decision makers and key influencers at North American apparel and textile goods manufacturers. We’ve distilled their insights and strategies into the Aptean 2023 Fashion and Apparel Manufacturing Report for North America: Manufacturer Insights and 5 Key Strategies for Growth.

Keep reading to discover five important insights from this industry-specific market research. Or, review the full industry report for a deeper dive, complete with suggestions for 2023 technology strategies that will help fashion and apparel manufacturers overcome internal and external challenges.

Insight #1: Rebuilding and Optimizing Supply Chains is a Top Priority

The COVID-19 pandemic brought two years of supply chain pain. Manufacturers suffered with long lead times for materials and had trouble aligning production schedules to available inventory. Price fluctuations as well as plant and warehouse disruptions further added to supply chain uncertainties.

2023 will be the year to build better supply chains. Manufacturers are focused on optimizing digital supply chains and improving resilience by finding new suppliers and vendors with more geographic variability.

Read the complete report to learn about the top five strategies apparel manufacturers are employing to protect against future disruptions.

Insight #2: To Bridge the Labor Shortage, Brands Will Focus on Productivity

More than four in ten apparel manufacturers have been challenged by staffing shortages over the past year. Manufacturers chose labor issues as both their top challenge and their second-most important key priority for the year to come. Brands can use automation to help employees become more productive. Greater efficiency can help manufacturers operate with a leaner staff.

Look inside the interactive report to find out how other fashion and apparel companies have overcome this challenge.

Insight #3: Brands will Drive Growth to Compensate for Rising Costs

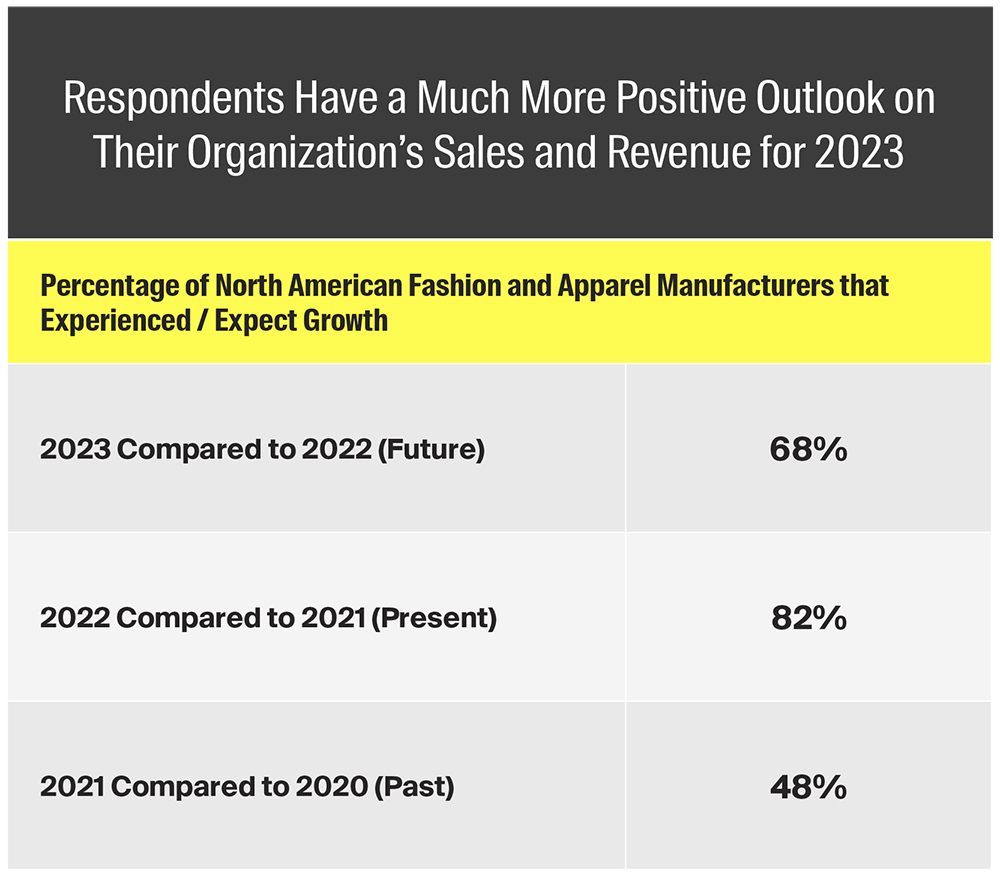

Despite challenging conditions, 82% of apparel manufacturers grew their revenue in 2022 versus 2021. What’s more, 68% anticipate topping last year’s numbers in 2023. As a group, apparel manufacturers are optimistic about growth.

What’s standing in the way of growth? Rising costs, labor constraints and inventory shortages. If inflation bites into consumer demand, downward pricing pressure could occur. Manufacturers need to focus on acquiring new customers and satisfying existing customers in order to protect profit margins. To outcompete, brands need to elevate their customer experience.

Download the full report to learn how organizations are using technology to strengthen customer relationships.

Insight #4: Manufacturers Will Seek to Ensure Compliance with ESG Mandates

Achieving sustainability goals is the top external pressure fashion brands anticipate for 2023. Apparel manufacturing has long been a target of ESG initiatives due to its oversized waste and emissions. Governments around the world are speeding up climate change mandates in anticipation of the United Nations’ 2030 Agenda. Apparel manufacturers are seeking innovative ways to reduce, reuse, recycle/upcycle and recover products and materials. Compliance with ESG mandates will require brands to improve tracking and reporting on sustainability metrics.

Read the complete report for ideas to strengthen traceability and sustainability with fashion-specific automation.

Insight #5: Digital Transformation is Already Paying Off

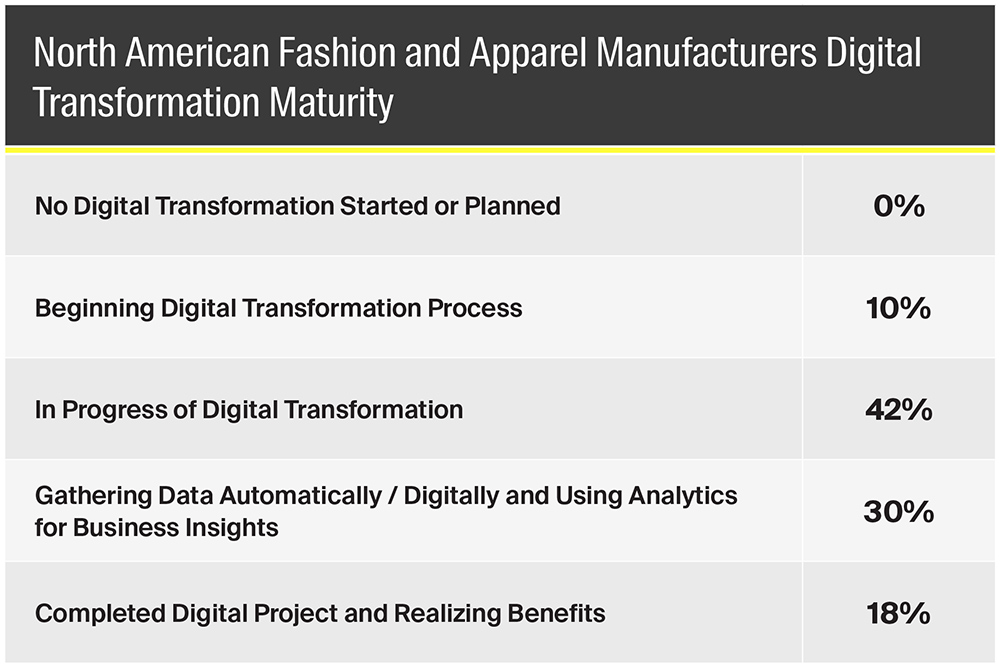

Among North American apparel manufacturers, 85% of manufacturers already have a digital transformation roadmap in place. Management and employees have fully bought in to the need for digital transformation, and most manufacturers are well on their way to completing their roadmaps. In fact, only 10% of apparel manufacturers were just beginning the process.

Brands in the later stages of their transformation journeys are already measuring success. Nearly half see KPI gains in their supply chains, helping them improve demand forecasting and more easily navigate around supply shortages.

Looking to leverage transformation strategies to ensure growth and protect profit margins? Download Aptean’s 2023 Fashion and Apparel Manufacturing Report to learn more about these insights and key strategies.

Ready to Transform Your Fashion and Apparel Business Today?

If you’re ready to take the next step, we’d love to help.