Accounting Software from Aptean - Fixed Asset

Accounting Software from Aptean - Fixed Asset

Accounting Software from Aptean - Fixed Asset

Mar 4, 2019

Aptean Staff Writer

Aptean Staff Writer Headline

- Analyze the Tax and Cash-flow Implications of Every Asset

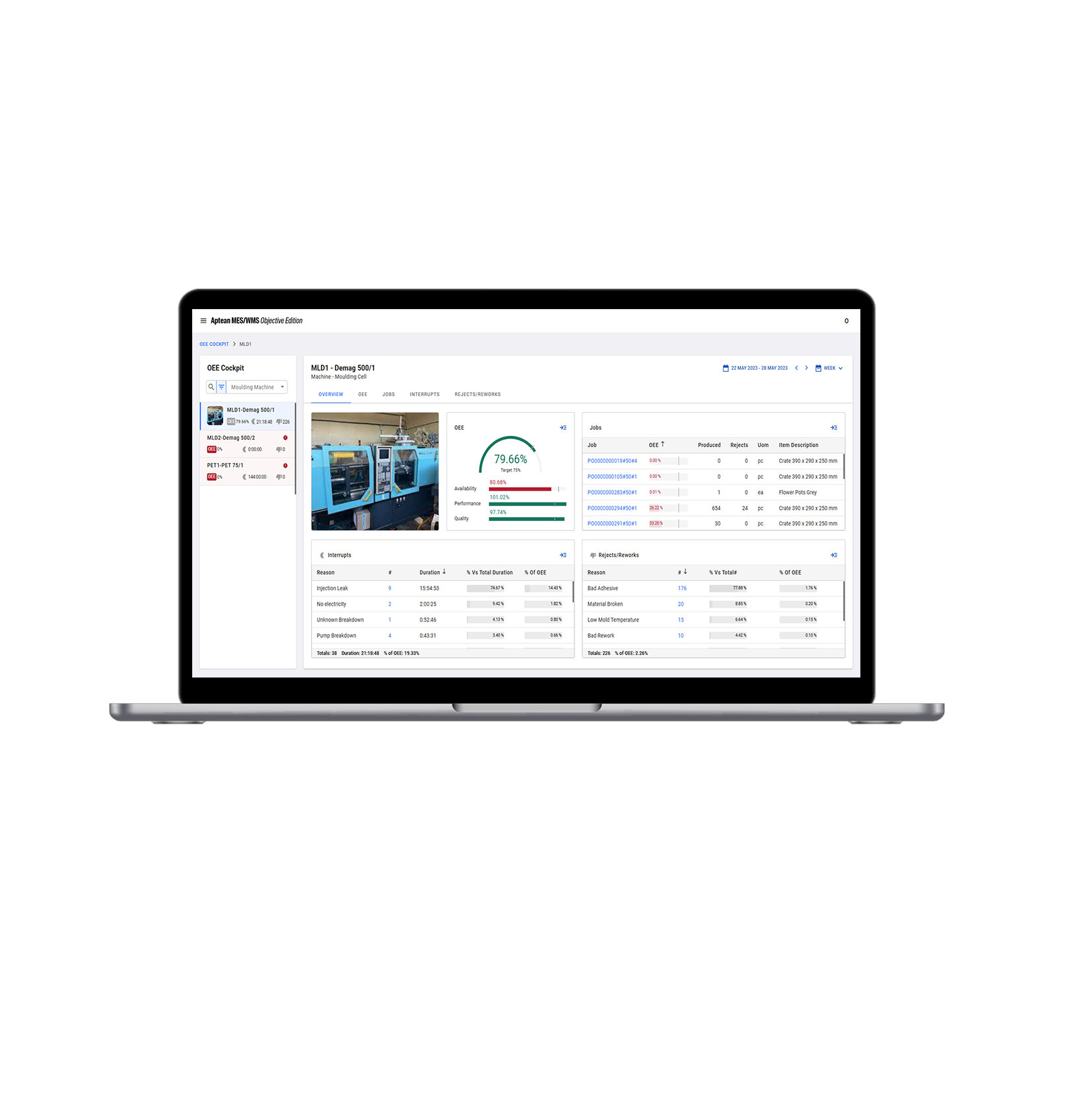

Make Better Decisions and Manage Fixed Asset Software With Ease

You need to analyze the tax and cash-flow implications of assets before you acquire them. Once you have them, you need to track their valuation and depreciation. Fixed Asset Software will help you make wise decisions about when to buy, when to lease, and how to manage your capital for maximum return. You’ll also have the full range of financial and management reports you need to manage your investments and meet tax reporting requirements.

Fixed Asset Management Software provides the forecasting tools you need to evaluate leases, amortize loans, and experiment with depreciation strategies before you make a capital commitment. You can keep a watchful eye on your depreciation options with four depreciation books that let you track four sets of depreciation information. You can also retire assets at any time. Track the difference between estimated depreciable and actual service life and calculate the cost or proceeds from the retirement of an asset.

You will also stay up to date with tax law changes. Fixed Asset Management provides a set of IRS-supplied depreciation tables and supports MACRS, ACRS, straight line, sum-of-the-year digits, and declining balance recovery methods. Flexible tables help you make changes easily to stay current with tax laws.

Fixed Asset Software Features:

Save money by using the Lease vs. Buy Analysis and Trial Depreciation functions to arrive at the most efficient depreciation strategy.

Easily review asset identification, acquisition, valuation, depreciation information, and disposal information with the Fixed Assets list and the Retired Assets list.

Calculate depreciation for a combination of books including book, federal tax, alternative minimum tax, and other (such as state or local).

Eliminate manual journal entries; the Aptean Industrial Manufacturing ERP General Ledger interface records accumulated depreciation expense entries automatically when you post.

Change the system to conform to your tax assessment and reporting needs with user-definable tax districts.

Group related assets for reporting purposes or link additions and adjustments to original assets by using multiple-part asset IDs.

Modify the system to conform to the way your business is organized with user-definable location fields.

Track actual and scheduled service maintenance dates with a description of work performed for each asset.

Want to learn more about how our industrial manufacturing ERP, Aptean Industrial Manufacturing ERP Traverse Edition, can help your business? Contact us today to chat with one of our experts or schedule a demo.

Start Transforming Your Business Today

If you’re ready to take your discrete and industrial manufacturing business to the next level, we’d love to help.